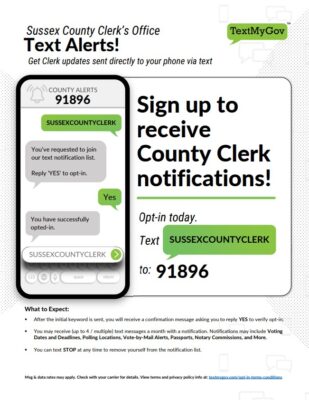

On March 7, 2024, All Future Election vote-by-mail voters will receive their first text alert from the County Clerk’s Office, letting them know about a new notification system being offered by their Clerk. The notifications will provide mail-in voters with important election updates, such as when the initial mass mailing of ballots goes out. The system will also provide voters and other residents who opt in with news about registration and party change deadlines, as well as updates to other services ranging from passports to notary commissions.

To opt out of receiving text alerts from the County Clerk just text STOP.